AARP® Medicare Supplement Insurance Plans insured by UnitedHealthcare® Insurance Company, or an affiliate, are health insurance plans designed to supplement Original Medicare. They help pay some or all the health care costs that Original Medicare does not cover (like copays, coinsurance and deductibles).

AARP Medicare Supplement Plans are available in all 50 states and the District of Columbia. UnitedHealthcare offers AARP Medicare Supplement Plans A, B, C, F, G, K, L and N in most states (Massachusetts, Minnesota and Wisconsin have unique plans and plan designations). Each plan has specific benefits so your consumers can find one to best meet their needs and budget! For customizable, plan-specific marketing materials to share with prospects, search "MS Plans" on the UHC Agent Toolkit.

You can enroll or disenroll your consumer in an AARP Medicare Supplement plan at any time during the year.

The following eligibility rules apply for AARP Medicare Supplement Plans. Applicants must be:

- Enrolled in Medicare Part A and Part B at the time of the plan effective date

- A resident of the state in which they are applying for coverage

- Age 65 or older on their plan effective date

- An AARP member (may enroll at time of application)

Check out the most up-to-date eligibility and plan availability information by going to Sales Tools and selecting JarvisEnroll (MedSupp), or visit the Sales Materials Portal for digital copies of materials.

If your client does not qualify for Open Enrollment or Guaranteed Issue, they will be underwritten to determine eligibility and/or the rate. Underwriting decisions are based on the information provided on the application and information received during the underwriting process.

Go to Sales Tools and select JarvisEnroll (MedSupp) for the most up-to-date underwriting and rates or visit the Sales Materials Portal Sales Materials Portal for digital copies of materials.

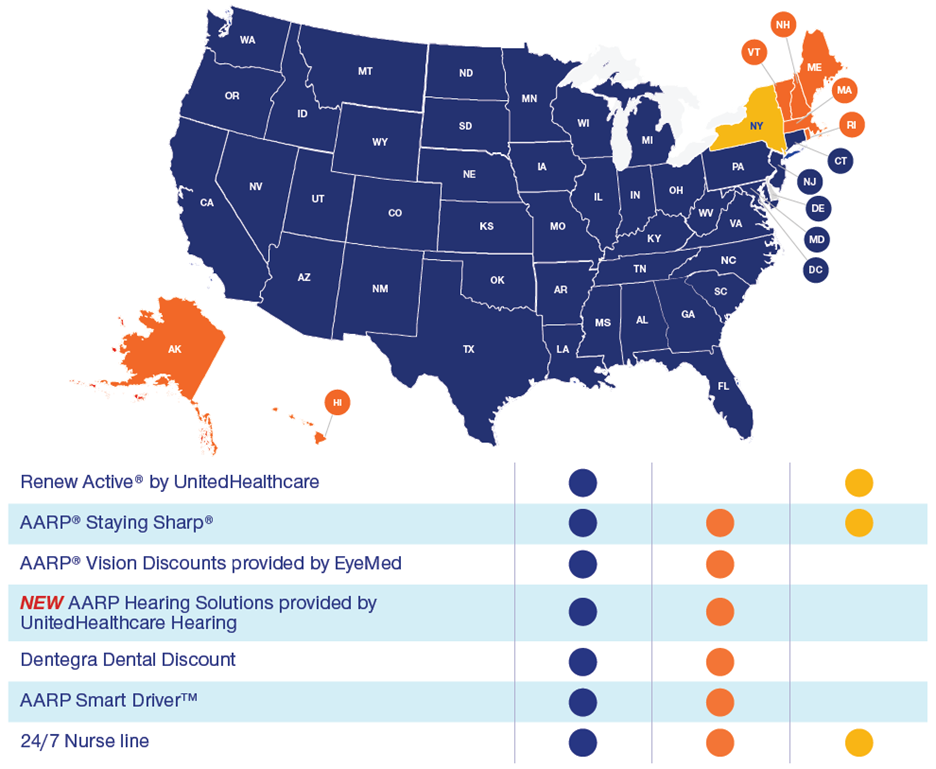

AARP Medicare Supplement Plans insured by UnitedHealthcare Insurance Company (UHIC) and insured by UnitedHealthcare Insurance Company of America (UHICA) in North Dakota offer Wellness Extras. Because Medicare supplement plans are standardized, UnitedHealthcare strives to differentiate ourselves in the market. Aside from our best-in-class service and valuable discounts, our Wellness Extras help to set us apart.

With our Wellness Extras, your clients have access to valuable discounts and services at no additional cost! These are separate from AARP Medicare Supplement Plan benefits and vary by state. For more detailed information, check out the Wellness Extras modules on Learning Lab.

With EZ Claim Pay service, your clients can choose to have UnitedHealthcare pay their Medicare Part B deductible expenses to the provider automatically on their behalf from their checking or savings account. EZ Claim Pay is offered at no additional cost to your members enrolled in an AARP Medicare Supplement Plan G.

Sample EZ Claim Pay Plan G Member Outreach Letter

Sample EZ Claim Pay Enrollment Form

Check out the EZ Claim Pay Plan G Member-Facing Flyer on the UHC Agent Toolkit. Simply search "EZCP" to start using it today!